DigiFundManager: Investment Software

Sets the conditions under which your past performance is your best predictor of expected portfolio performance.

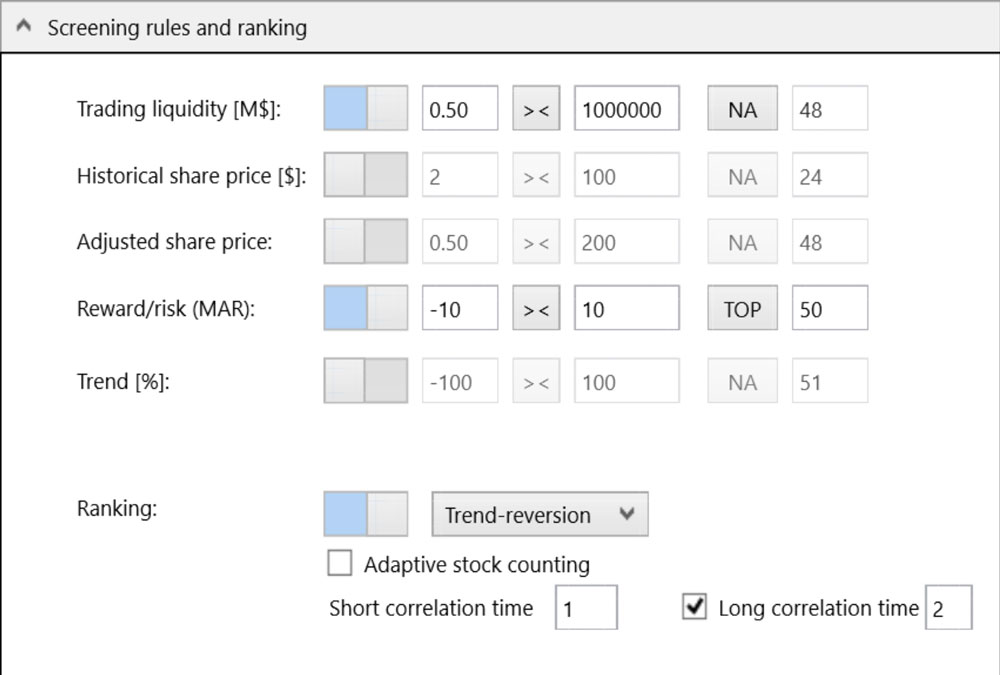

- Each week, it screens stocks from any list and ranks them by decreasing likelihood to increase in price taking the highest/lowest ranks as the best long/short positions (StatArb).

- It times portfolios by searching for peaks in the autocorrelations in the random non-stationary price fluctuations since the IPOs on Wall Street (Wiener-Khinchin-Einstein).

- It uses fixed holding periods as the uncertainty of performance predictions based on non-uniform sampling requires a double average sampling rate for the same interpolation accuracy.

- It weights portfolios in each holding period by maximizing returns and/or minimizing risks using gradient descent techniques.

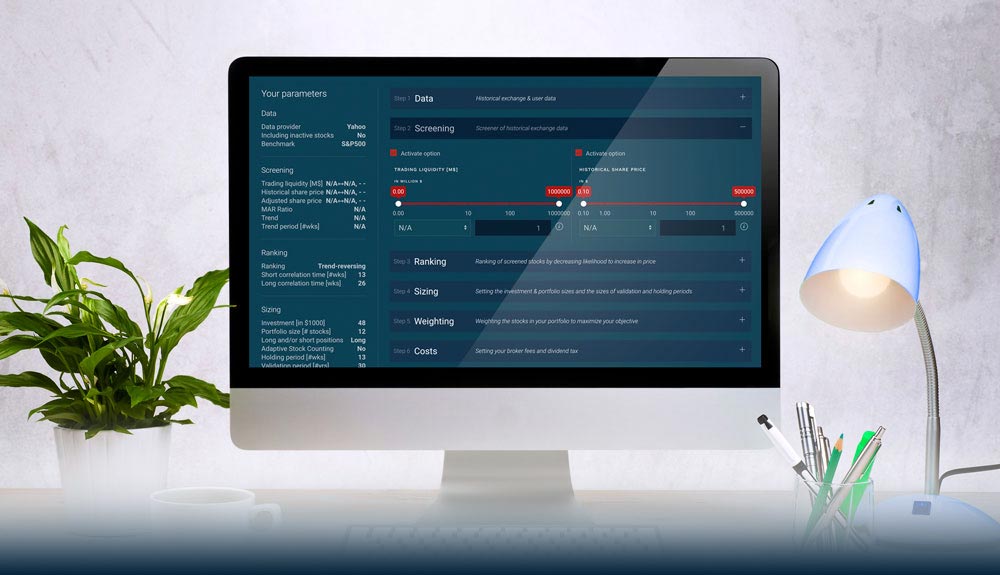

Portfolio managers use screening, ranking, weighting, timing, sizing, and back testing to compute optimal portfolios that outperform the market. Perfect Competition sets a cap on investments upto $500M.

Fractional shares can level the playing field between large and retail investors when trading the securities in any watchlist with optimal timing and diversification.

DigiFundManager introduces a mathematical model for market timing

- You can screen, rank, size, optimally time & weight your portfolios,

- from 60 years of historical eod exchange data (CSI).

- Import your own WatchList or edit your own out of 8000 non-OTC stocks.

- Set ranking in trend-following or mean-reversion mode.

- Runs in your browser of choice or on pc's with Windows 10 & 11.

- For people new in the field of quantitative investing, we made A short introductory slide show.

- For more advanced investors, we made Four in-depth video presentations.

Best two DJIA-stocks of the week:

15 Apr 2024

INTC

(Intel Corp)

JPM

(J P Morgan Chase & Co)

EXPECTED ANNUAL RETURN =20.4%, YTD =-4.9%, MAR = 0.60

Safe investing

Watch the slide show to the right to learn how to minimize your risks and maximize your annual expected returns using DigiFundManager

Expected risks and rewards are averages of the past. Averages have spreads, so that they never warrant future performance. Spreads are indicators for risks.

-

1. The broker account

To trade equity, you need to open an investment account with a broker or bank and deposit money that you want to invest. This financial company should enable you to process your buy and sell orders of shares of stocks on Wall Street. It should also enable you to process Market on Close (MOC) orders, hence to trade shares at end-of-day prices, which can be back tested.

-

2. Buying/selling of own and borrowed shares

When you buy shares of the stocks of a company, you do that with the expectation that they will increase in value. You hold them for a certain time to let them grow and then sell them. You may also borrow shares of stocks from your broker and sell them with the expectation that they will decrease in value. You hold those for a certain time to let them decrease in price and then buy them back. -

3. Watch lists

Fund Managers select their portfolios from a watchlist. There are about 7000 non-Over-The-Counter (OTC) stocks on Wall Street, which regularly report their financials to the Securities & Exchange Commission (SEC). Our screening conditions can screen any smaller watchlist from this General WatchList. Like only stocks from the tech sector or utility sector, or any of the major Indices. -

4. Active investing in computed stock portfolios

1. How to timely select the stocks from a watchlist most expected to grow or to lower in price?

2. How long to hold on to them to maximize returns and/or minimize drawdowns?

3. How many shares to trade of each of them, given your total investment?

4. What are your long-term expected annual returns and maximum drawdowns by repeating consecutive holdings 1- 3 over economic upturns and downturns? -

5. Managing expectations by four algorithms

1. Stock selections by Statistical-Arbitrage.

2. Market timing by Spectral-Analysis.

3. Stock allocations by Economic-Forecasting.

4. Quantifying returns and risks by Back Testing. -

6. Screening & ranking by DigiFundManager

-

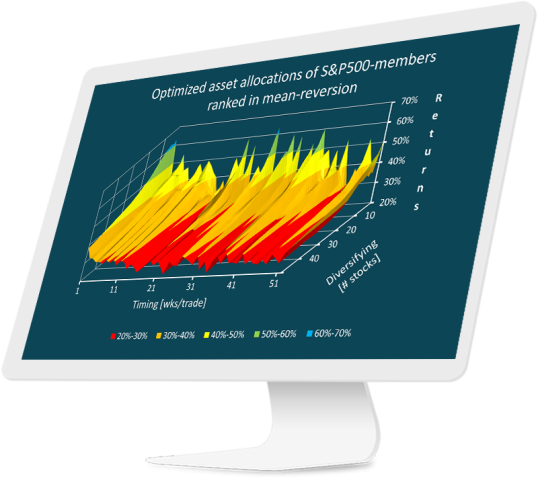

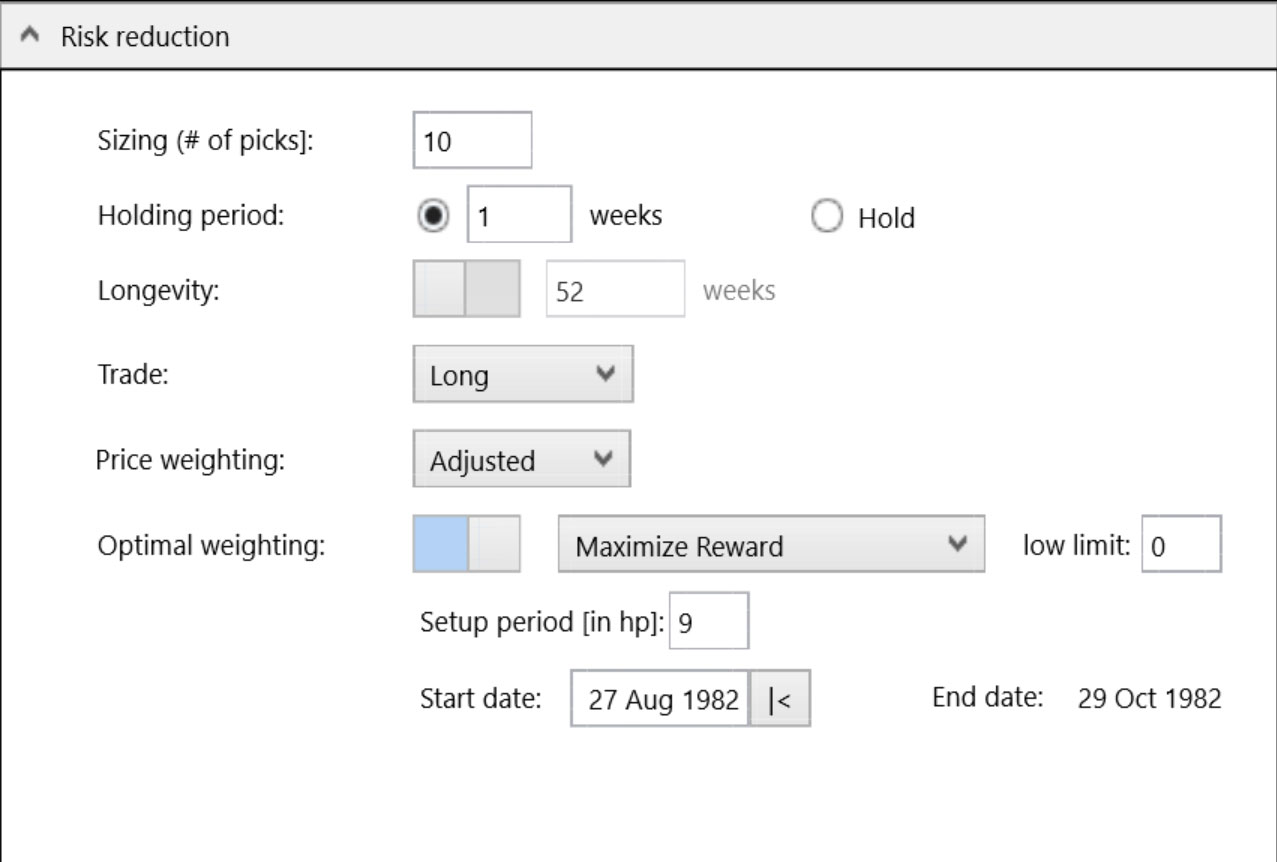

7. Risk Reduction best #10 by DigiFundManager

-

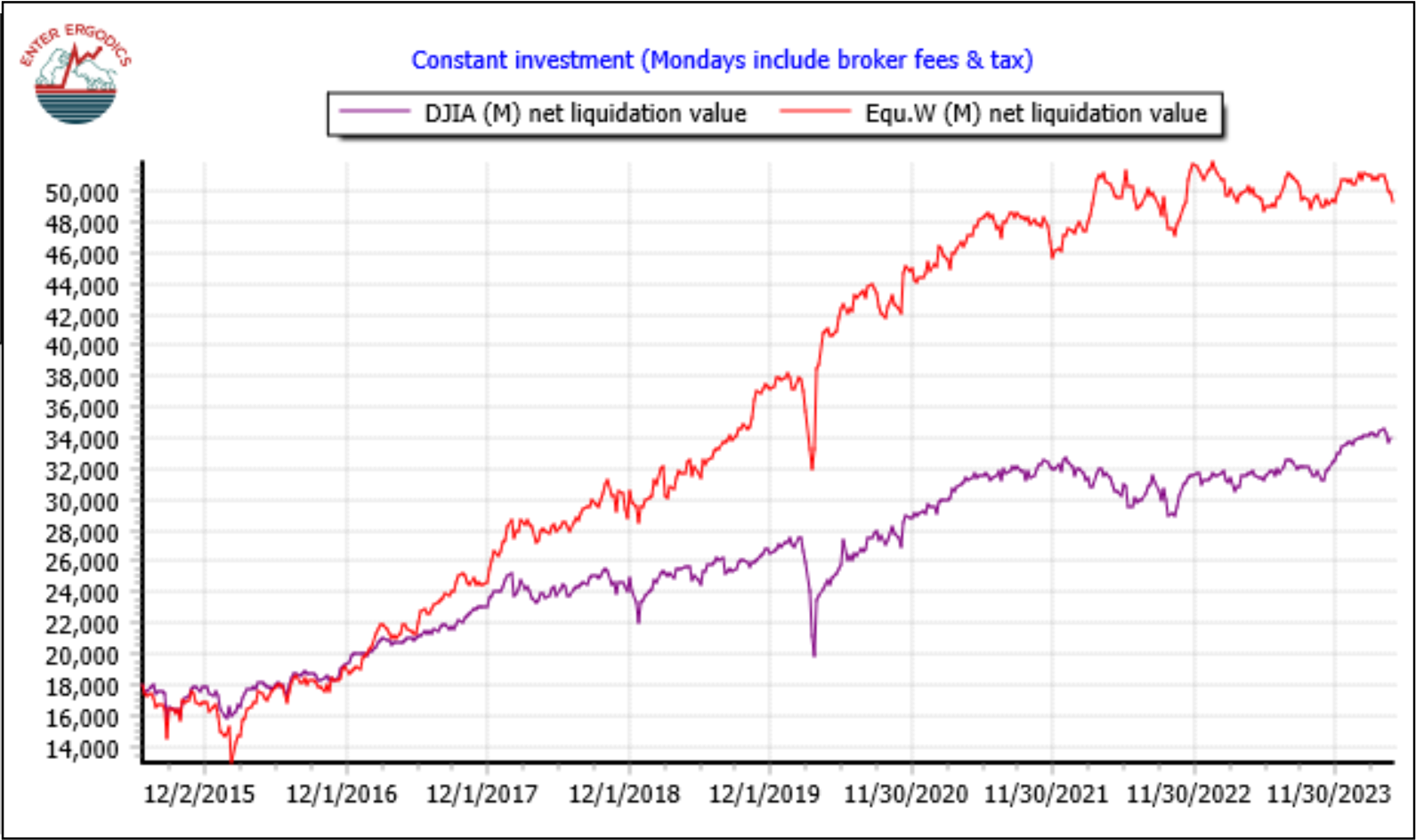

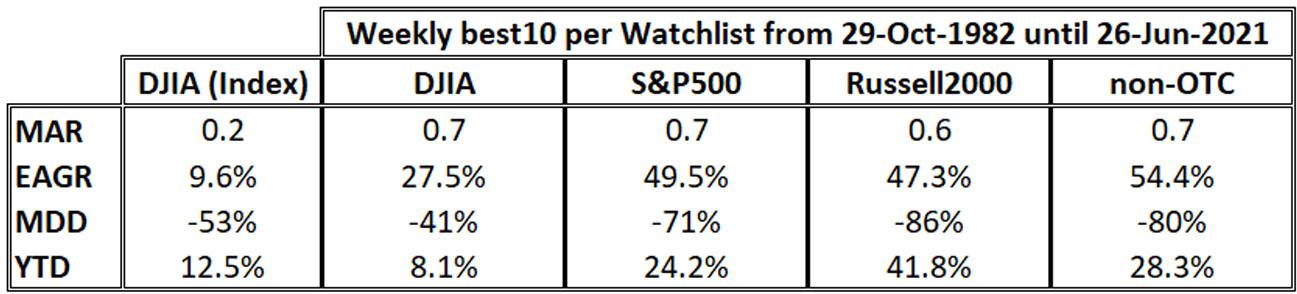

8. Quantified returns and risks per watchlist

EAGR = Expected Annual Growth Rate (Reward)

CAGR = Compounded Annual Growth Rate

MDD = Maximum Draw Down (Risk)

MAR = EAGR/I MDD I (Reward/Risk ratio)

YTD = Year-To-Date -

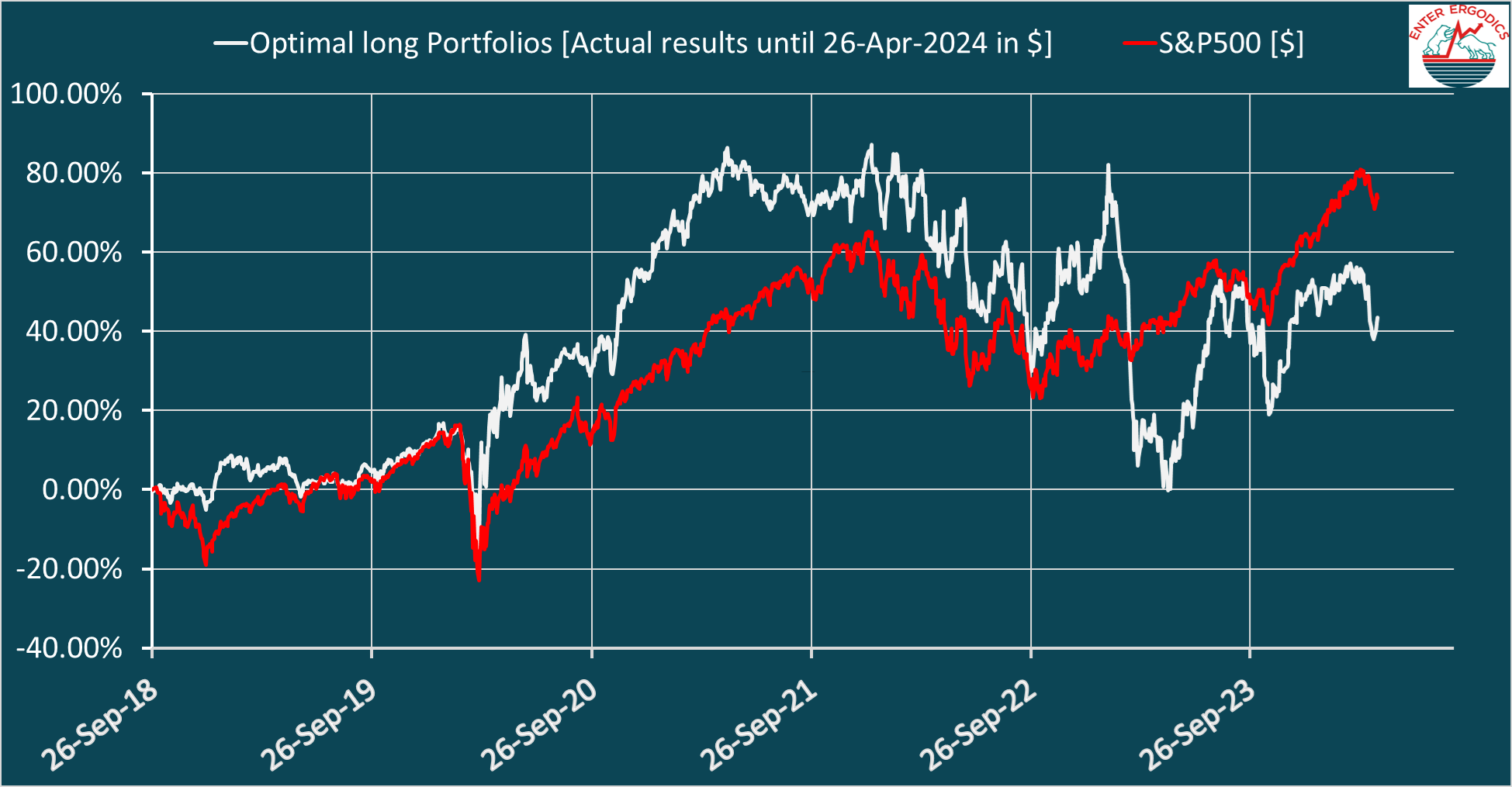

9. DigiFundManager in action

-

10. Got any questions left?

Please let us know!